Coronavirus: the impact on the electricity market

It is difficult at this stage to determine all the impacts that the coronavirus epidemic will have on the electricity sector. Some effects will be felt in the short term, and others in the longer term. Intuitively, we can already sketch out the outlines.

Boris Solier, University of Montpellier and Jacques Percebois, University of Montpellier

Shutterstock

Electricity is a basic necessity and, like any public service, it is subject to three principles: continuity, equal treatment, and adaptability.

The first of these is vital here. There is no cause for concern on this front, as operators (EDF, RTE, and Enedis) have plans in place to ensure that nuclear and thermal power plants will continue to operate—even with 40% absenteeism in the event of a peak in the epidemic—and that the networks will remain operational.

Priority is given to operational staff, who run the power plants and repair power lines. Support staff can continue to work remotely. In fact, they must come to the site as little as possible to avoid contaminating the agents who operate the power plants, particularly nuclear plants, as happened at the Flamanville Power Plant, where the "pandemic plan" was activated on March 16, 2020.

A decline in electricity demand

Electricity demand fell sharply in March, mainly due to the economic downturn. The electricity transmission system operator announced a "15% decline" on March 18.

The cause is the slowdown or even shutdown of industry, commerce, and transportation (high-speed trains, subways, trams). This situation is therefore likely to worsen.

The growing use of digital technology due to teleworking and lockdown (digital technology usually accounts for around 10% of electricity consumption in France, and consumption in this sector is estimated to have increased by 40 to 50% during the pandemic) is unlikely to offset the decline in electricity demand in other sectors, far from it.

It should also be noted that the Energy Regulatory Commission is asking EDF and RTE to stop applying the peak hour system, which allows certain customers to benefit from tariffs that vary according to the time of year, proving that demand for electricity is falling. With this system, the price paid by the end consumer is relatively low for much of the year, when consumption is low, but rises sharply during periods of high consumption, particularly in winter, encouraging consumers to reduce their demand.

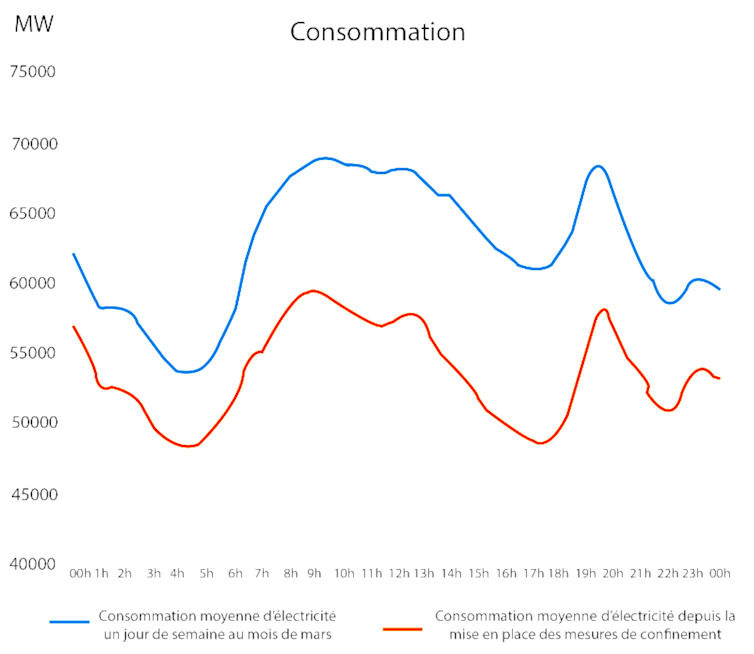

We can also expect a reduction in daily peaks, i.e., a flattening of the electricity demand curve.

Traditionally, electricity consumption peaks around 8 a.m., when businesses start their activities. The reduction in economic activity and the lockdown measures put in place are therefore tending to mitigate this daily consumption peak and smooth out the demand curve. "The use of tariff reductions to limit consumption peaks now appears to be of little use and could, moreover, lead to an increase in bills for the consumers concerned," the CRE also points out.

RTE

Electricity prices

France has a surplus of electricity capacity and temperatures are fairly mild, especially as we head into spring. There is therefore no cause for concern regarding electricity supply. Demand, on the other hand, is likely to decline sharply. This has and will continue to have an impact on wholesale electricity prices—and, in turn, on the revenues of electricity producers and suppliers (EDF and alternative suppliers).

As power plants are called upon to supply the grid in order of increasing marginal cost, the means of production with the lowest variable costs (renewable and nuclear) are used first to meet electricity demand. Gas- and coal-fired power plants, whose variable production costs are significantly higher, will therefore be the most likely to be affected by the decline in consumption.

Admittedly, gas prices are very low as they follow oil prices, which are themselves in free fall, but the reduction in the cost of producing a thermal kWh will not change the principle that priority is given to renewable energies (run-of-river hydro, solar, and wind) and nuclear power. On the contrary, the decline in demand could accelerate the already begun decline of coal in electricity production in Europe.

With the wholesale price per kWh falling, the price including tax should also fall slightly for the end consumer. It should be noted that electricity supply accounts for only one-third of the bill we pay, with the rest corresponding to the cost of transmission and distribution and taxes.

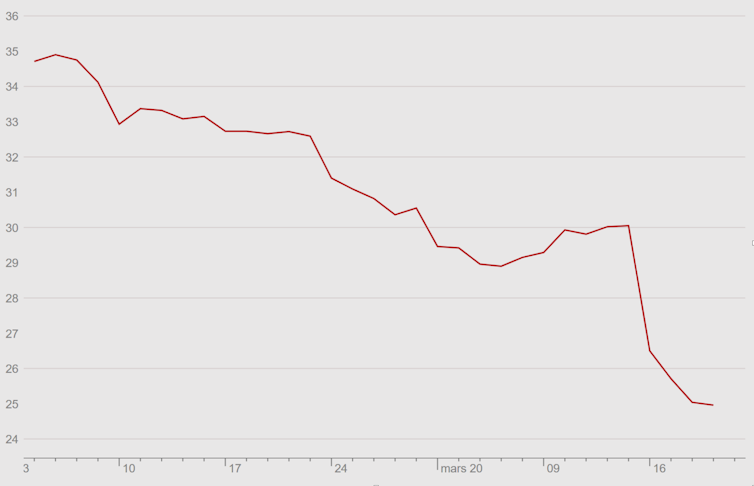

At the same time, the price per ton of CO₂ collapsed on the European market, falling in a matter of weeks from €24 on March 10 to €15 on March 23, due to the decline in thermal power generation and thereforeCO₂ emissions in Europe.

Although the French electricity mix is more than 90% carbon-free, this should reinforce the decline in wholesale prices due to interconnections with other Western European countries that emit moreCO2.

EEX, CC BY-NC-ND

Market capitalization

The decline in revenues for electricity producers and suppliers will result in a drop in their stock market value. The market capitalization of these operators is expected to follow the trend observed on all global stock markets.

Certain investments in electricity generation (gas-fired power plants, for example) will become "stranded costs" insofar as they will only be required to operate for a small number of hours per year, which will not ensure their profitability.

Ultimately, the situation will undoubtedly lead to bankruptcies for the most fragile operators, or at least to a wave of mergers and acquisitions. This is true on a global scale, and probably in Europe too; it is less certain in France, given the weight of the incumbent operator, which remains largely public.

A decline in future investments

It is undoubtedly in terms of investment that the effects will ultimately be most severe. The sustained decline in demand for electricity, which is likely to continue if France enters a prolonged recession (negative economic growth), will be accompanied by a fall in operators' revenues and cash flow.

We can therefore expect to see the postponement of certain nuclear renovation investments, as well as a reduction in investments in new projects (renewable energies and even new nuclear energy).

Similarly, the plunge in oil prices significantly increases the relative cost of investing in low-carbon energy and risks affecting energy efficiency, due to a lack of financial resources and because the electricity bill will have fallen slightly for the end consumer. The fight against global warming and the reduction of energy consumption are likely to take a back seat in the coming months for many economic actors—starting with public decision-makers.

It is likely that, for all these reasons, the process of liberalizing the energy sector will be slowed down and the reform of the electricity market postponed indefinitely.

Let's not forget that electricity accounts for only a quarter of the final energy consumption in FrancePetroleum products account for the bulk of this consumption (46%). The situation in other sectors will also have a direct or indirect effect on the electricity sector. Anticipating all interactions is difficult, especially since we do not know how long the global crisis will last or what its longer-term effects on the economy will be.![]()

Boris Solier, Senior Lecturer in Economics, Associate Researcher at Art-Dev and Chair of Climate Economics, University of Montpellier and Jacques Percebois, Professor Emeritus of Economics, Associate Researcher at the Chair of Climate Economics (Paris-Dauphine), University of Montpellier

This article is republished from The Conversation under a Creative Commons license. Readthe original article.