COVID-19: the straw that broke the camel's back?

Protests and crisis in Hong Kong (a key platform for wines in Asia) in 2019, Brexit, US sanctions (Trump tariffs) and now Covid-19: international trade news in recent months has been anything but boring, and the wine industry, which is heavily export-oriented, is inevitably feeling the consequences.

Carole Maurel, University of Montpellier

The wine market has already weathered many crises and has proven its resilience. However, according to forecasts by IWSR, global wine sales could fall by 13% in 2020 due to the current crisis, reflecting a more severe impact than during the 2008 financial crisis.

These economic difficulties are creating significant uncertainty among stakeholders, many of whom are small and medium-sized exporting companies, and are exacerbating certain structural difficulties that stakeholders were still managing to contain before COVID-19.

FranceAgrimer economic report

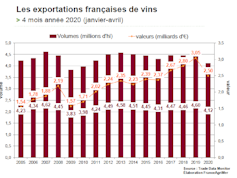

The latest economic report from FranceAgrimer (July 2020) confirms the downward trend in French exports over the first four months of 2020 (-16% in volume and -36% in value compared to April 2019) across all wine categories, with Champagne experiencing the sharpest decline.

Let's take a look at France's global rankings in 2019:3rd largest vineyard area,2nd largest producer and consumer,3rd largest exporter by volume and, above all,1st largest exporter by value ahead of Italy and Spain.

Unfortunately, the current situation is a real-life example of the impact of the environment on export performance and the health of wine businesses, and the need to encourage the resumption of trade relations and initiatives to develop and promote sales.

Website

Given this unprecedented situation, we analyzed the content of 238 articles extracted using the search engine of Vitisphère, an information, networking, and specialized services portal dedicated to professionals in the wine industry, covering the period from March1, 2020, to July 26, 2020.

The aim of the initiative was to use a dynamic approach to assess the impact of the current health crisis on exporting companies in the French wine industry, as well as the initiatives and responses of stakeholders to this crisis. Here are some of the key findings from our study over the last five months.

International and domestic sales down

As a direct consequence of lockdown measures and border closures—from China in January to Europe in February–March and the American continent in March—international activity came to a standstill during this period. This is evidenced by the numerous postponements of international trade shows in the summer of 2020 and even into 2021.

These events are essential for the commercial development of companies in the sector, and their postponement is hampering their international activity, even though innovative initiatives have been developed with online trade shows. These postponements mean a drop in cash flow and missed opportunities to develop and maintain networks with French and foreign customers.

Another sign of the halt in international activity is the blockage of the supply chain: ports are saturated, and port and airport activity has come to a standstill.

Similarly, lockdown measures and border closures have forced sales teams to halt their travel activities, particularly for exports, replacing them with remote working, which is necessary to maintain business relationships from a distance.

IRI for FranceAgriMer-CNIV

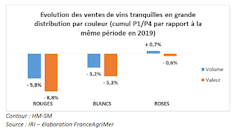

In addition to this international setback, the health crisis has led to a decline and change in consumption on the domestic market: the failure of spring wine fairs in supermarkets, the suspension of activity in cafés, hotels, and restaurants (CHR), and the suspension of wine tourism.

See also:

What Covid-19 reveals about wine consumption cultures around the world

FranceAgrimer's economic report confirms the decline in appellations d'origine contrôlée (AOC), the stability of indications géographiques protégées (IGP), and the sharp increase in bag-in-box wine dispensers.

A sharper decline is expected in the high-end segments, particularly due to the closure of hotels, restaurants, and cafés and the lack of social opportunities caused by lockdown measures. However, the impact on industry players varies depending on two factors: their level of dependence on these channels and the situation in the region of production prior to the crisis.

Private wineries appear to be more affected than cooperative wineries due to their heavy reliance on cellar sales, the hotel and restaurant sector, and wine tourism, in addition to the slowdown in exports.

Furthermore, in Bordeaux, for example, this crisis is exacerbating the difficulties faced by the industry, which has been experiencing a slowdown in domestic and Chinese consumption in particular for the past two years, and is already having to cope with structural overproduction due to changes in the types of wine in demand and the environmental shift that needs to be made, not to mention the many climatic uncertainties of 2020.

Boom in online sales

From early March, journalists were speculating about the transfer of some of the lost international consumption to the domestic market and the opportunities for e-commerce (confirmed bya study by IRI showing a 179% increase in online sales in March-April).

In addition, this lockdown has been an opportunity for some winegrowers to innovate and launch their online sales sites, enabling certain shipments in France and Europe. Others have launched home delivery or "click and collect" services at their wine cellars.

Anne-Christine Poujoulat/AFP

The same upward trend can be seen in auctions. In Hong Kong (the world's leading online wine auction site), there was an increase in online sales in March 2020, replacing live auctions. It remains to be seen whether these trends will continue in the coming months.

Excess stocks cause concern

One catalyst is on everyone's mind in this context of declining sales opportunities for wine in France and abroad: excess stocks (estimated at 3 million hectoliters by the industry).

Inventories are an essential part of the operating cycle for companies in the sector and contribute significantly to cash flow requirements.

Declining sales, lower yields, and unpredictable weather conditions are all factors that are disrupting the balance of stocks for players in the sector. Today, we can see how important this is for the sustainability of these companies.

That is why the entire sector has been lobbying the European Union, the French government, regional authorities, and banks over the past five months to obtain measures and aid to manage these surplus stocks, with a view to the 2020 harvest, for which storage capacity needs to be freed up.

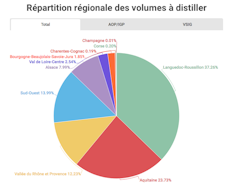

Crisis distillation and private storage were at the heart of the discussions, alongside requests for exemptions from charges for loss of business or aid for promotion and marketing.

Vitisphère website

However, not all stakeholders and regions have the same needs in terms of aid—the Bordeaux and Languedoc regions have a greater need for distillation (accounting for 60% of requests) than regions such as Champagne, Burgundy, or Alsace, for example.

Other complementary measures are being considered, such as individual complementary volumes, interprofessional reserves, and the possibility of increasing the proportion of the 2019 vintage in the 2020 vintage.

Given climate change and the likelihood of further crises in the future, it seems essential to consider a toolkit for managing both downward variations (in the event of poor harvests, for example) and upward variations in wine stocks, which affect companies' financing needs and operational risk and threaten their sustainability.

This toolkit will need to take into account the diversity of situations and profiles of the stakeholders involved, as this crisis shows us once again that the wine industry has many faces and that a single, generalized solution is not appropriate.

Finally, while for some the current crisis has been an opportunity to show solidarity (donations of alcohol for the production of hand sanitizer, charity sales, promotion of wine tourism), this period is above all a chance to reflect on the future, strategy, and business plans.

To bounce back, wine producers have no choice but to draw conclusions from the trends revealed during the crisis: corporate social responsibility, online sales, development of "bag-in-box" packaging in the hotel and restaurant sector to reduce carbon footprint, among others. These are all challenges to be met in this period of uncertainty for the French wine industry and its sustainability.![]()

Carole Maurel, Associate Professor in Corporate Finance and International Management, University of Montpellier

This article is republished from The Conversation under a Creative Commons license. Readthe original article.