Why is it so difficult to manage a hypergrowth company?

Many business leaders dream of hypergrowth. Being at the helm and heart of a company that is experiencing accelerated growth of more than 20% per year for at least three years has become a real ambition for entrepreneurs.

Bénédicte Aldebert, Aix-Marseille University (AMU) and Ophélie Laboury-Barthez, University of Montpellier

Indeed, this is precisely what happened with Google, Facebook, and Airbnb. However, hypergrowth is a real disruptive factor in the life of a company. Whether the company is young or more mature, hypergrowth generates radical instability, which weakens it, and the way out of this situation too often corresponds to the failure of the company. How can we explain and prevent the tensions arising from this exceptional situation from causing failure?

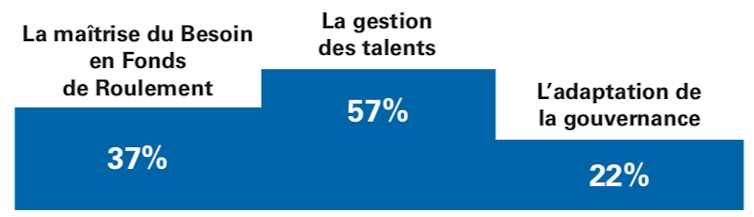

We focused our analysis on the issue of governance, which emerges as one of the main challenges (along with recruitment and cash flow) faced by hypergrowth companies, according to a recent KPMG study.

Excerpt from the study "Hypergrowth: the challenge facing the French entrepreneurial ecosystem" (KMPG, 2018)

Governance plays a key role in managing the delicate balance between the various paradoxes faced by hypergrowth companies. We therefore embarked on an unprecedented exploration of a sample of 10 hypergrowth companies and their ecosystems. Following this analysis, we present our initial observations and findings on the governance of hypergrowth companies.

Different approaches

Corporate governance is a theoretical concept originally formulated for large companies that deals with the balance of power within a company between those responsible for the company's performance, investors, and other stakeholders.

To simplify, there are two main types of approaches that seek to understand the regulation of relationships between shareholders, stakeholders, and managers within companies.

The first approach, which is contractual and disciplinary in nature, focuses more on the relationship between shareholders and executives and questions the role of the board of directors and ways to limit the discretion of executives. This was particularly the case with Carlos Ghosn when he was at the helm of Renault-Nissan.

A second, more recent alternative approach focuses on understanding the knowledge and resources required and mobilized by the manager for the development of the company. It is known as cognitive and behavioral.

The CEOs of hypergrowth companies we interviewed have adopted this type of cognitive governance, which focuses on the value creation process and places particular importance on building skills, innovation capabilities, and changing their business environment. CEOs emphasize that this type of governance is preferable to disciplinary governance practices for managing tensions.

The company in its adolescence

A hypergrowth company must quickly manage conflicting situations, and most of the time it is not prepared to do so. Research has shed light on four major paradoxes within organizations that are particularly acute in hypergrowth companies. These paradoxes concern:

- Learning: Hypergrowth pushes the company to explore new knowledge (often with a long maturation period, acting by trial and error) while continuing to exploit its own knowledge (i.e., day-to-day operationalization). The company must be ambidextrous and therefore know how to streamline without becoming too rigid and while retaining what has made it strong, often improvisation, innovation, and flexibility.

- Identity: the rapid expansion of the company's size is not keeping pace with the acceptance of these changes by long-standing teams, leading to fears that the founding cultural model may be eroding.

- An organization that arises from the delicate balance between control and autonomy, or between stability and change. One executive we interviewed put it this way: "I give them a lot of freedom (referring to employees), but I want to control everything."

- Performance: Hypergrowth brings with it many new and diverse stakeholders (e.g., new partners or employees) whose interests may be contradictory and conflicting.

Amidst all these tensions, our study shows that leaders feel they must primarily deal with organizational tensions.

In summary, hypergrowth corresponds to a situation where a company transitions from infancy to adulthood through an acute, exacerbated, and accelerated adolescence.

Four levers for effective governance

Our exploration led us to identify four main levers to activate in order to implement governance adapted to a situation of hypergrowth:

- Accepting tensions within the company: leaders must acknowledge that their behavior and the situation of hypergrowth generate tensions, and allow themselves to build their company with these tensions in mind. Fighting against these tensions would be counterproductive for the health of both the leader and the company. The solution lies in skillfully combining these tensions to find balance.

- Building a culture of hypergrowth: the arrival of all new employees requires special attention to ensure that the company's identity and values are not lost. It may be useful to create routines for sharing with employees, communicating the company's vision and purpose, and also providing opportunities for discussion about upcoming changes. These moments synchronize and align employee behavior with that of the company.

- Take the time to build governance: this involves anticipating and initiating internal structuring by setting up a management team, customizing the shareholder agreement, and choosing your financial partners. This must be accompanied by a strengthening of the legitimacy of the manager, who must question his or her abilities and skills at each stage: is he or she doing it or having it done? Is he or she more of a manager or a leader? Should he or she intervene in operational or strategic matters?

- Ensure the legitimacy of governance: the governance put in place will enable the various paradoxes and tensions encountered to be managed. This governance must be cognitive in order to build trust, relationships, networks, and expertise, but it must also be disciplinary, with the implementation of metrics and financial ratios to inform decision-making and secure the exit from hypergrowth. As one executive we interviewed pointed out: "In hypergrowth, it is essential to have financial and commercial indicators. Driving a Formula 1 car blindfolded is fine, you're going 300 km/h, but you don't know if there's a turn coming [...]. If you don't have indicators, you'll crash into the wall." This balance between cognitive and disciplinary governance will facilitate dialogue with all stakeholders and bring entrepreneurial ambition to fruition.

In conclusion, hypergrowth is a phase that can seriously jeopardize a company's survival. This is difficult to imagine, as hypergrowth is widely associated with success. However, appropriate governance is necessary to ensure the best possible distribution of power between management and stakeholders, taking into account organizational paradoxes and not neglecting the company's culture.

This contribution is based on the article entitled "Can a gazelle be governed like an elephant? A study of tensions and governance in hypergrowth companies," Boulmakoul N., Aldebert B., and Amabile S. (2019), presented at the18th conference of the International Association for Strategic Management (AIMS) and supported by Ophélie Laboury-Barthez.![]()

Bénédicte Aldebert, Senior Lecturer, Entrepreneurship, Aix-Marseille University (AMU) and Ophélie Laboury-Barthez, Adjunct Professor in Strategy and Innovation Management, University of Montpellier

This article is republished from The Conversation under a Creative Commons license. Readthe original article.