Share buybacks: in the face of market excesses, regulation remains too timid

Contemporary world news is not lacking in major issues on which public opinion expects economic and political leaders to take concrete decisions that are likely to help improve the situation. Among these many topical issues, we would like to focus on share buybacks by companies, which are seemingly technical operations that are little known to the public. However, they are worth studying in terms of the behavior they reveal and their economic impact.

Elisabeth Walliser, Université Côte d’Azur and Roland Pérez, University of Montpellier

For many years now, these transactions, which were once rare or even prohibited, have become very common. These share buybacks significantly alter the functioning of financial markets, as they can be likened to stock price manipulation.

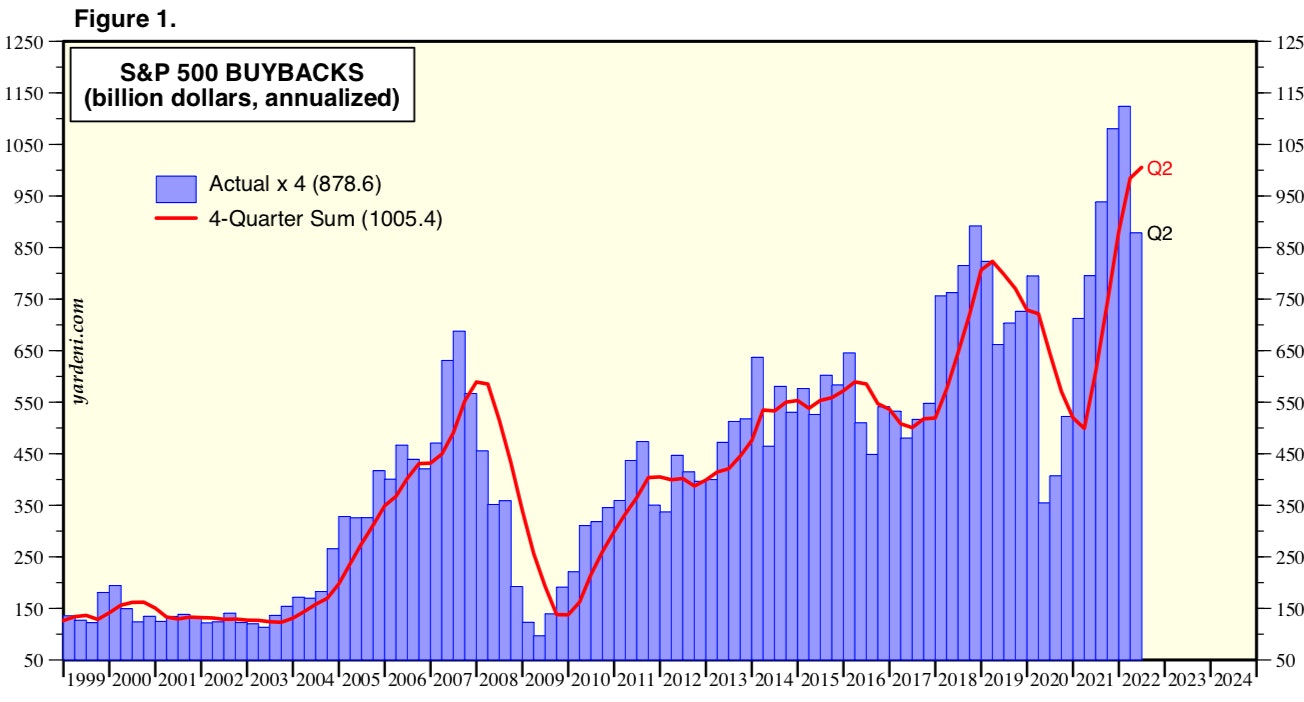

In 2019, we had already drawn attention to this worrying trend on the US stock markets. Since then, this trend has continued, driven by "accommodative" monetary policies (quantitative easing, or QE, in Europe, and zero interest rate policy, or ZIRP, in the United States) facilitating access to credit and amplified, in the United States, by the tax measures taken under Donald Trump's presidency to encourage American multinational companies to repatriate cash assets held abroad.

Yardeni.com

At the end of 2021, the amount of these share buybacks even exceeded the $1 trillion mark in annual flows for the S&P 500 alone, the stock market index based on 500 large listed companies. These annual flows have become larger than those of dividends paid. For example, in 2021, Apple carried out $85.5 billion in share buybacks for $14.5 billion in dividends. Over the last ten years, the Cupertino-based company's total share buybacks amount to $567 billion. In some years, the total flow of dividends and share buybacks has even exceeded the flow of new share issues, thereby reversing the financing function of the financial markets.

A trend that is spreading across Europe

In other parts of the world, these transactions are less massive but are beginning to become significant. On September1, the newspaper Les Échos wrote: "Large European companies have turned en masse to share buybacks since the pandemic. They have tripled in one year to reach €70 billion in the first half of the year in Europe, including €15 billion in France."

Thus, the Total Energies group has launched a new share buyback plan "in line with its announced policy of allocating up to 40% of surplus cash generated above $60 per barrel to share buybacks," the same newspaper reported a month earlier; these are expected to reach $7 billion in 2022.

[Nearly 80,000 readers trust The Conversation newsletter to help them better understand the world's major issues. Subscribe today]

Given the magnitude of this quasi-tsunami, the modest response from both the authorities concerned and the research community is surprising. The measures taken or envisaged by the authorities responsible for these issues are modest. In the United States, after much procrastination, the Securities and Exchange Commission (SEC), the US stock market regulator, published new regulations on these transactions at the end of 2021, aimed primarily at improving the information required. In addition, in August 2022, the US Senate voted for a slight tax (1%, applicable from January 2023).

In other parts of the world, however, particularly in Europe, we have not yet heard of any draft decisions on this matter, unlike other related but distinct issues, such as "superprofits" and their possible taxation...

Mainstream finance

The silence, or at least the paucity, of research devoted to the issue of share buybacks seems even more surprising. Admittedly, there are a number of studies that have focused on these issues, sometimes with great insight, but the researchers involved are often marginalized in the academic world of finance. The latter remains largely dominated by a theoretical construct developed over several decades, forming a paradigm—known as "mainstream finance"—which researchers, it must be acknowledged, find difficult to break free from.

A share buyback program can therefore be easily explained using the concept of free cash flow, which refers to the cash flow available once investments have paid for themselves. Executives are encouraged to return this surplus cash to shareholders rather than using it in a suboptimal way. Share buybacks thus appear to be a means of disciplining managers and reflectshareholder-oriented corporate governance, as recommended by this school of thought.

Such theoretical justification may have made many finance professionals smile. Admittedly, share buybacks can be an appropriate solution in specific situations (e.g., the death of a co-founder of a company whose other partners wish to retain exclusive control) or, more broadly, for listed companies, to change the shareholding structure by reducing the free float in favor of stable shareholders.

However, beyond these capital distribution operations, the main purpose of these share buyback announcements is to please shareholders in the short term by supporting the stock prices of the companies concerned. Executives who propose such maneuvers also benefit from them, as strong stock prices have become a major expression of their ability to "create value," and incentive instruments have been created for this purpose (such as stock options).

Necessary regulation

We can talk about "maneuvers" or "signals" because many of these operations remain only at the declarative level and are not carried out; others are carried out but are then followed by a capital increase, thus moving in the opposite direction. This result therefore appears consistent with the hypothesis of price manipulation.

However, when these transactions result in the cancellation of the repurchased shares and a parallel reduction in both the cash resources and equity of the company concerned, the latter could find itself in difficulty in the event of subsequent events (or opportunities) requiring rapid and significant financing to deal with them; This situation is, moreover, consistent with a disciplined approach to shareholder-oriented governance, as the financial market is called upon to assess the situation.

As we can see from these few examples and initial reflections, it seems desirable that financial professionals, the general public, research institutions, and sovereign authorities should all be made aware of the issues raised by this excessive use of share buybacks, so that the necessary regulations can be put in place.

Elisabeth Walliser, Director of IAE Nice, Research Group (GRM), Université Côte d’Azur and Roland Pérez, University Professor (retired), Montpellier Research in Management, University of Montpellier

This article is republished from The Conversation under a Creative Commons license. Readthe original article.