Share buybacks: regulation still too timid in the face of market excesses

In today's world, there is no shortage of major issues on which public opinion expects economic and political leaders to make concrete decisions that will help improve the situation. Among these many topical issues, we would like to focus on company share buy-backs, apparently technical operations little known to the public. Yet these operations deserve to be studied in terms of the behaviors they reveal and their economic impact.

Elisabeth Walliser, Côte d'Azur University and Roland Pérez, University of Montpellier

For many years now, these operations, once rare or even forbidden, have become very frequent. These share buy-backs significantly alter the way financial markets operate, as they can be tantamount to stock price manipulation.

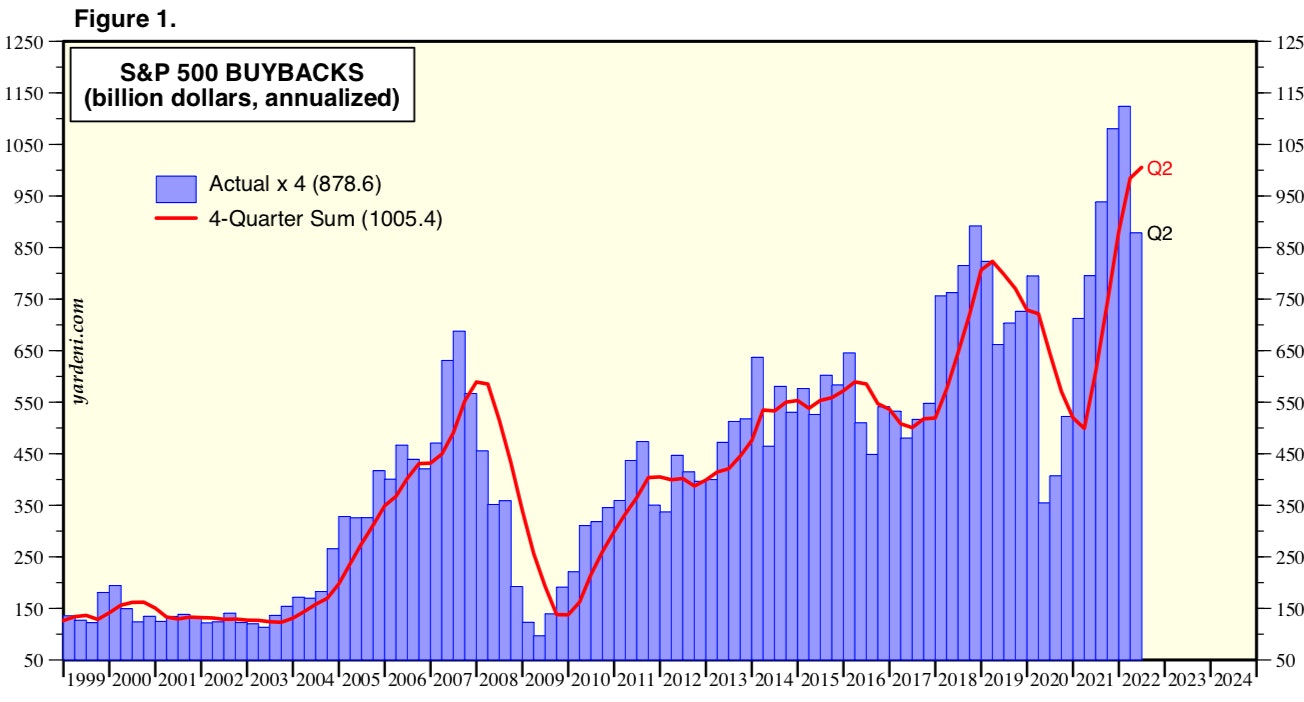

Back in 2019, we drew attention to this worrying wave on the US stock markets. Since then, this wave has continued, driven by "accommodating" monetary policies(quantitative easing, or QE, in Europe, and zero interest rate policy, or ZIRP, in the US) facilitating the use of credit and amplified, in the US, by tax measures taken under President Donald Trump to encourage US multinational firms to repatriate liquid assets placed abroad.

Yardeni.com

By the end of 2021, share buybacks had even exceeded the $1,000 billion mark in annual flows for the S&P 500 alone, the stock market index based on 500 large listed companies. These annual flows have become more voluminous than those of dividends paid. In 2021, for example, Apple paid out $85.5 billion in share buybacks for $14.5 in dividends. Over the last ten years, the Cupertino-based company's total share buybacks amounted to $567 billion. In some years, the total flow of dividends and share buybacks even exceeded the flow of new share issues, thus reversing the financing function of the financial markets.

A trend that's spreading across Europe

In other parts of the world, these operations are less gigantic, but are starting to become significant. On September1, the French newspaper Les Echos wrote: "large European companies have massively turned to share buybacks since the pandemic. They have tripled in the space of a year, reaching 70 billion euros in the first half of the year in Europe, including 15 billion in France".

The Total Energies group, for example, has launched a new share buyback plan "in line with the announced policy of allocating up to 40% of surplus cash generated above $60/barrel to share buybacks", noted the same newspaper a month earlier, which should reach $7 billion by 2022.

[Nearly 80,000 readers trust The Conversation newsletter to better understand the world's major issues. Subscribe today]

Compared to this near-tsunami, we are astonished by the modest reactions of both the authorities concerned and the research community. At the level of the authorities in charge of these issues, the measures taken or envisaged are modest. In the United States, after much prevarication, the Securities and Exchange Commission (SEC), the American stock market watchdog, published new regulations for these operations at the end of 2021, aimed essentially at improving the information required. In addition, in August 2022, the US Senate voted for a slight tax (1%, applicable from January 2023).

In other parts of the world, however, and particularly in Europe, we have not yet heard of any plans to make decisions in this area, unlike other related but distinct issues, such as "superprofits" and their possible taxation...

Mainstream finance

Even more surprising is the silence, or at least the paucity, of research devoted to the issue of share buybacks. Admittedly, there are a number of works that have focused on these issues, sometimes with acuity; but the researchers concerned are often marginalized in the academic world of finance. The latter remains largely dominated by a theoretical construct developed over several decades, forming a paradigm - known as "mainstream finance" - from which researchers admittedly find it difficult to break free.

In this way, a share buyback operation can easily be explained in terms of the concept of free cash-flow, which refers to the flow of cash available once investments have paid for themselves. Management is encouraged to return this surplus cash to shareholders, rather than using it in a sub-optimal way. The share buyback operation thus appears to be a means of disciplining management and expressingshareholder-oriented corporate governance, as recommended by this school of thought.

Such theoretical justification may have made many financial professionals smile. Admittedly, share buy-backs can be an appropriate solution to resolve specific situations (for example, the death of a co-founding member of a company whose other partners wish to retain exclusive control) or, more generally, for listed companies, to modify the shareholder structure by reducing the proportion of "free float" in favor of stable shareholders.

Nevertheless, beyond these operations aimed at capital distribution, the main purpose of these share buyback announcements is to please shareholders in the short term by bolstering the share prices of the companies concerned. The executives who propose such maneuvers also benefit from them, as the good performance of stock prices has become a major expression of their ability to "create value", and incentive instruments have been created for this purpose (e.g. stock options).

Necessary regulation

We can speak of "maneuvers" or "signals", as many of these operations remain only at the declarative level and are not carried out; others are, but are then followed by a capital increase, thus in the opposite direction. This result is therefore consistent with the hypothesis of price manipulation.

On the other hand, when these operations result in the cancellation of the shares bought back, and a parallel reduction in both the cash resources and equity of the company concerned, the latter could find itself in difficulty in the event of subsequent events (or opportunities) requiring rapid and significant financing to meet them; a situation which, incidentally, is in line with a disciplinary approach to shareholder-oriented governance, with the financial market called upon to assess the situation.

As can be seen from these examples and initial reflections, it would seem desirable for finance professionals and the general public, research institutions and government authorities alike, to become aware of the stakes involved in excessive share buybacks, and to introduce much-needed regulation.

Elisabeth Walliser, Director of IAE Nice, Management Research Group (GRM), Université Côte d'Azur and Roland Pérez, University Professor (e.r.), Montpellier Research in Management, University of Montpellier

This article is republished from The Conversation under a Creative Commons license. Read theoriginal article.